As they prepare for the fast-approaching Third International Conference on Financing for Development in Addis Ababa (July 13-16, 2015), policymakers, private sector actors, and other global leaders should examine the types of external financial flows (defined as the sum of gross private capital flows, official development assistance (ODA), and remittances) that different groupings of countries receive in order to best support the implementation of the post-2015 development agenda. Understanding how different sources of development finance flow to different parts of Africa can help identify priority areas of intervention.

In a recent study, Brookings Africa Growth Initiative scholars explore the different types of external financial flows and their prevalence in sub-Saharan Africa, and discuss what those trends suggest about and for the region. (This report is third in a number of studies the Brookings Africa Growth Initiative is conducting on financing for development in the run-up to the conference in Addis. Previous reports looked at the financing of African infrastructure and the trends and developments in African frontier bond markets.)

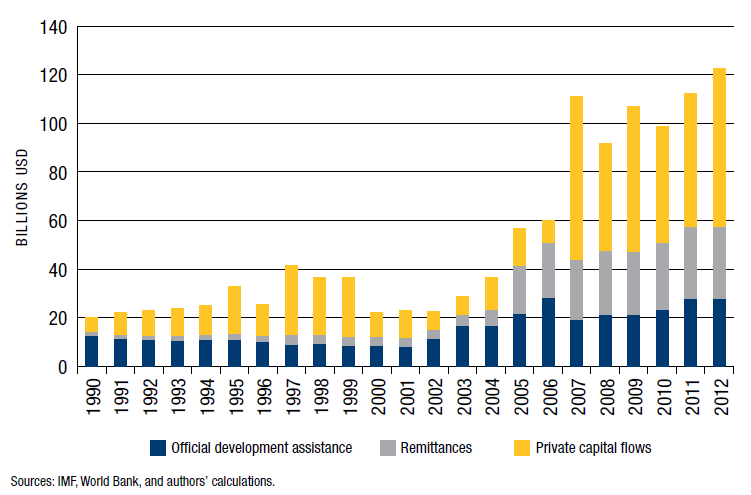

The good news is that external financial flows to sub-Saharan Africa have increased significantly over the past 20 years or so. In fact, the volume of external flows reached about $120 billion in 2012—from $20 billion in 1990. As seen in Figure 1, the composition of external flows has also changed a lot: Most of the increase in external flows to sub-Saharan Africa can be attributed to the increase in private capital flows, which are now higher than ODA. The share of ODA fell from 62 percent of total external flows in 1990 to 22 percent in 2012, and 17 countries received more foreign direct investment (FDI) than ODA in 2012.

Figure 1. Sub-Saharan Africa: Composition of External Flows (1990-2012)

But to what extent have these changes in the scale and composition of external flows to sub-Saharan Africa equally benefited countries in the region? Did the rising tide lift all boats? Is aid really dying? Are all countries attracting private capital flows and benefiting from remittances to the same degree? Finally, how does external finance compares with domestic finance?

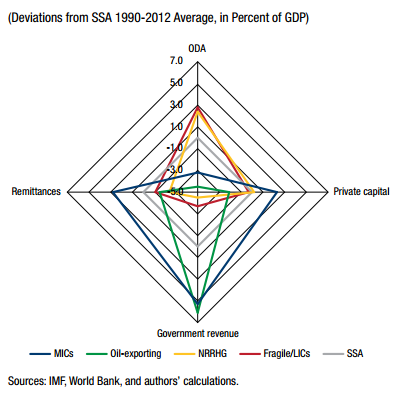

To answer these questions, in our study we grouped sub-Saharan African countries into several different categories and studied how they differ in terms of the type of flows that they receive. We also compared countries in terms of the government revenues they raise. We grouped countries by income levels, growth performance, international capital markets access, geography, colonial heritage, and regional economic community to explore how the external flows differ around the continent. For example, as seen in Figure 2, we find that the type of external financial flow to non-resource-rich high-growth (NRRHG) and fragile states/low-income countries differs significantly from that of both middle-income and oil-exporting countries.

Figure 2. Sub-Saharan Africa: External Flows by Income Level

Our main finding is that changes in both the scale and composition of external capital flows have not benefited all sub-Saharan African countries equally. We also find that the claim of the demise of aid is premature, the growth of private capital flows has benefited only a few countries, remittances have become significantly more important for some countries, and the rise of external flows means that sub-Saharan African countries will have to manage the volatility associated with such flows. In particular, we find that:

- Fragile countries and LICs, not surprisingly, are regional laggards in terms of access to both external and domestic finance.

- Even resource-rich countries, which are able to attract large volumes of private capital flows, fare relatively poorly when external financing flows are scaled to the size of their economies. In addition, these countries, although they raise more domestic government revenues than other countries, do so mostly because they benefit from fiscal revenues linked to volatile commodity prices.

- Francophone countries both in the WAEMU and the CEMAC are not able to attract the same level of private capital flows as other sub-Saharan African countries.

- Remittances are high for middle-income countries.

- When external financing is contrasted with domestic financing, it seems that sub-Saharan African countries do not appear to have a natural hedge to the risks of reversal of external financial flows.

For more detail on these and other findings, see our study, Private capital flows, official development assistance, and remittances to Africa: Who gets what?

Commentary

How finance flows to Africa

May 20, 2015